INSURANCE

TELEMATICS

We're able to generate actionable insights and superior data intelligence for insurance companies, enabling them to make better business decisions.

Top 5 Business Benefits of Insurance Telematics

Reduce cost of claims

Encourage safe driving patterns

Increase number of low-risk drivers

Ensure innovations in the business

Improve customer loyalty and retention rate

How YouTrack Helps

Insurance Companies?

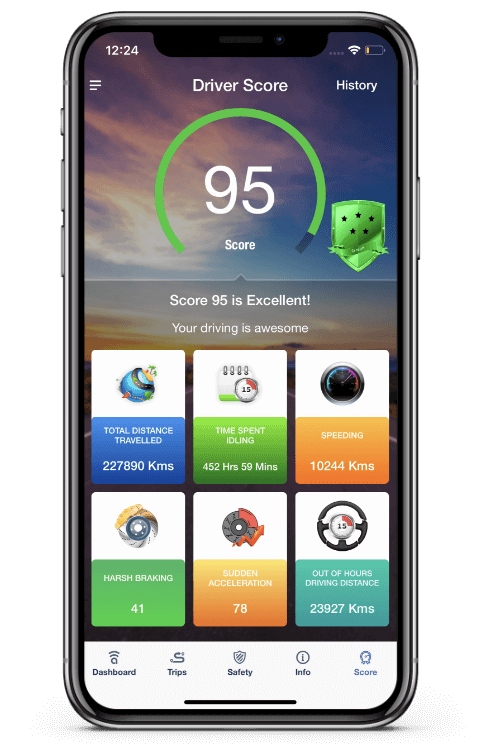

- Value added experience for your customers

- Data rich analytics

- New business generation

- Risk and loss management

- Intuitive car protection powered by Amber Shield®

- A customizable white label for your own branded app

Telematics Data Capture

- Driver behavior (speeding, cornering, harsh braking, sudden acceleration)

- Mileage

- Out of hours driving

- Fatigue driving

- Frequently parked locations

- No-go zones

- Business/personal trip classification

- Accident reconstruction

- Accident hot spots pre-warning & hotspot passing

- Behavior risk analytics

- Wrong - way driving

- Use of mobile phone while driving

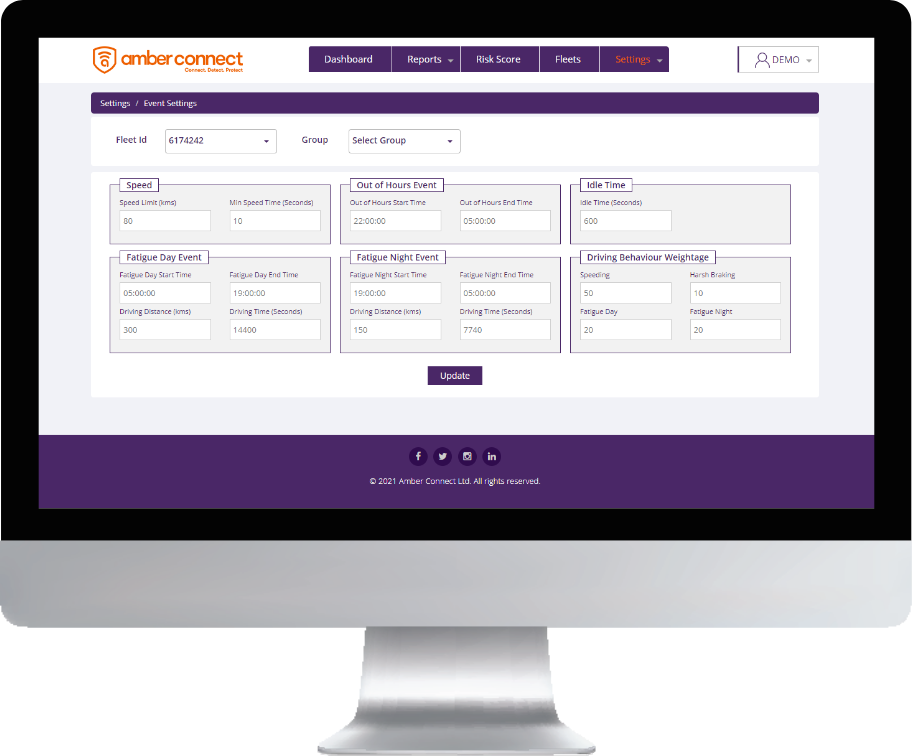

Risk Managment Telematics Portal

Score Setting

A telematics policy and driver score management platform with accident claims

reconstruction right from a single portal. Insurer configurable thresholds for

scoring with built in analytics and business intelligence modules.

Fleet Risk Telematics

Get risk scores for all your insured fleet on a single portal. Create your own risk

thresholds and download extensive reports.

Data Integration Options

- Custom integration of telematics data into client data warehouse (DW)

- Rest API's endpoints available for custom integrations.

- A white label application hosted on client premise with ready built customizable driver scoring module and analytics.

- SAS based solution for customizable driver scoring module and analytics